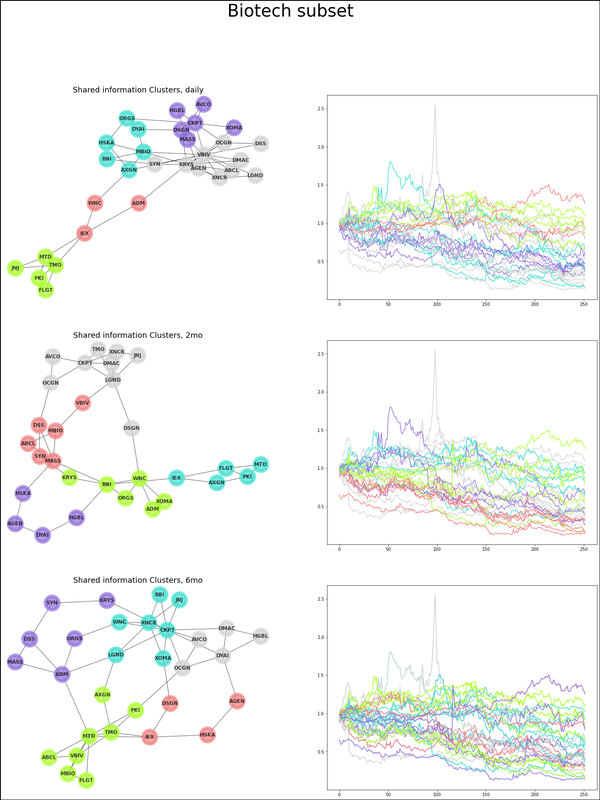

July 19th, 20227/19/2022 Concurrently Shared Information Consi is a measure of same-time dependence between time series, in this case, company stock prices. Using the consi measures, we get a truer idea of the extent of relation among companies' prices. After obtaining the consi measures, we then create an initial connected network of the companies (in this case biotech companies) and then use graph-based clustering to group the companies into price information groups. The information groups can then be analyzed to find the underlying shared pricing component. Comparing shared pricing components across the groups enables us to compare behavior and performance of the groups.

Here consi measured for shared information for 1 day, 2 month, and 6 month returns to demonstrate that comovement and shared information changes depending on the time period.

0 Comments

Leave a Reply.AuthorI'm the cofounder of a fintech startup Archives

July 2022

Categories |

RSS Feed

RSS Feed